President Donald Trump announced on Feb. 27 that he would indeed be imposing 25% tariffs on Canada and Mexico and adding an additional 10% tariff on top of the 10% tariff that was already imposed on China in February.

While the impact on the destination retail industry remains to be seen, organizations that represent vendors and retailers are making their voices heard in Washington.

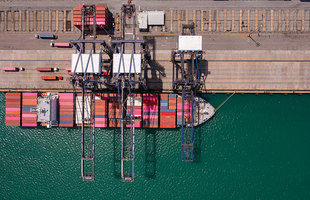

In early February, the National Retail Federation reported imports at the nation’s major container ports are expected to remain high as retailers continue to bring in cargo ahead of growing tariffs on China and threats against other countries, according to the Global Port Tracker report released Feb. 7 by the National Retail Federation and Hackett Associates.

“Supply chains are complex,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Retailers continue to engage in diversification efforts. Unfortunately, it takes significant time to move supply chains, even if you can find available capacity. While we support the need to address the fentanyl crisis at our borders, new tariffs on China and other countries will mean higher prices for American families. Retailers have engaged in mitigation strategies to minimize the potential impact of tariffs, including frontloading of some products, but that can lead to increased challenges because of added warehousing and related costs. We hope to resolve our outstanding border security issues as quickly as possible because there will be a significant impact on the economy if increased tariffs are maintained and expanded.”

NRF also noted that retailers have been frontloading imports of key products for several months because of the potential for the East Coast/Gulf Coast port strike in January as well as to get ahead of potential tariffs.

Hackett Associates Founder Ben Hackett said tariffs on Canada and Mexico would initially have minimal impact at ports because most imports from either country move by truck, rail or pipeline. In the long term, tariffs on goods that receive final manufacturing in Canada or Mexico but originate elsewhere could prompt an increase in direct maritime imports to the U.S. In the meantime, port cargo “could be badly hit” if tariffs on overseas Asian and European nations increase prices and prompt consumers to buy less, he said.

National Retail Federation Executive Vice President of Government Relations David French also issued a statement Feb. 13 regarding the Trump administration’s plan to impose reciprocal tariffs on all trading partners.

“While we support the president’s efforts to reduce trade barriers and imbalances, this scale of undertaking is massive and will be extremely disruptive to our supply chains. It will likely result in higher prices for hardworking American families and will erode household spending power. We encourage the president to seek coordination and collaboration with our trading partners and bring stability to our supply chains and family budgets," he said.

The Toy Association is another related industry association making sure its voice is heard in Washington. It announced on Feb. 4 that it remains actively engaged in discussions on this issue to ensure the voice of the toy industry is heard loud and clear by congressional leaders and White House officials. The Toy Association’s President & CEO Greg Ahearn, Chief Policy Officer Kathrin Belliveau, and Toy Association members have all been spreading awareness about the impact tariffs on toys would have on American families and businesses.

The Toy Association has developed key talking points for conversations with representatives relating to tariffs. Companies that would like to use The Toy Association’s resources and template letters, as well as information on how they can connect with their federal representatives, are invited to reach out to Kathrin Belliveau, chief policy officer at The Toy Association at kbelliveau@toyassociation.org.